Many of us ask the question, ‘How much would I need to retire right now?’ or wonder if you do indeed have enough to retire right now. You may be going through a business exit and have received an offer, but what does that offer actually mean for you? Are you able to contextualise what that lump sum would mean for your life, and what sort of life it would be able to afford you?

Using basic assumptions such as guaranteed incomes, desired annual expenditure and reasonable levels of assumed growth, this is a number that we are able to calculate. To plan around this number we undertake cashflow modelling for which we use an industry leading FinTech tool called CashCalc - this is an exercise we call Finding your Number.

THE Number: A lump sum of capital sufficient to provide your desired level of income from a specified date for the rest of your life.

What does this mean for you?

Finding your Number enables you to understand what your current assets will be able to provide you with through retirement, and consider legacy estate planning and your inheritance tax position.

Taking this number into a business exit discussion enables you to approach negotiations with an understanding of what you need from an offer to fund your desired lifestyle.

What do we do?

We work with you to help build reasonable expenditure goals, including both your regular day-to-day living costs and holidays, as well as future one off purchases whether that be a caravan, holiday home or a yacht! We also use this time to understand your attitude towards investment risk, available assets and any guaranteed incomes, either future or current, to ensure the assumptions are reasonable and achievable. By considering all of this information, we are able to Find your Number and build a detailed cashflow plan.

How we do it

Using cashflow modelling software, we look at your anticipated expenditure, alongside any guaranteed incomes such as final salary pensions and State Pension, to create an expenditure ‘deficit’. This picture can sometimes seem shocking initially, but this is only the 1st step of our process.

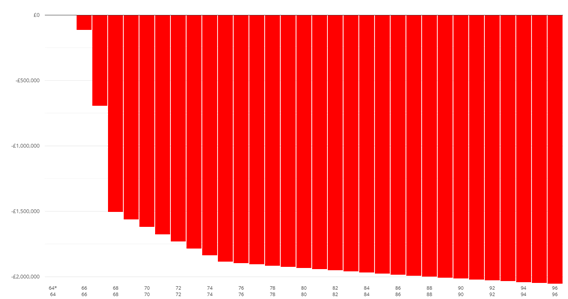

From here we determine the capital required to cover this expenditure for life, at the date the capital sum is expected to be received, i.e. at retirement and/or on your business exit. We forecast the capital required at various levels of growth (i.e. pessimistic, medium, optimistic) to reflect your individual attitude to investment risk.

We then apply the capital injection to a pot and provide a forecast view of this capital over your life.

What do you need to do?

Start planning as early as possible and ensure you consider all the options available to you. Our advisers are experienced in advising you on the most tax efficient way to use all of your existing assets, and at helping you Find Your Number and assisting you in using this to your advantage when making significant life changing decisions.

Call: 01633 851805

Email: info@nichepc.co.uk

Office: 5 & 6 Waterside Court, Albany St, Newport, NP20 5NT

Become a client Client login

The contents of this article do not constitute financial advice in any way; if you have any concerns about your finances you should talk to your financial adviser. The value of your investments can go down as well as up.

< Back to News