Cashflow planning

What is Cashflow planning?

Former FCA regulator and financial services specialist, Rory Percival, defines cashflow planning as something to help determine the sustainability of a client’s income versus their outgoings over the years of their life.

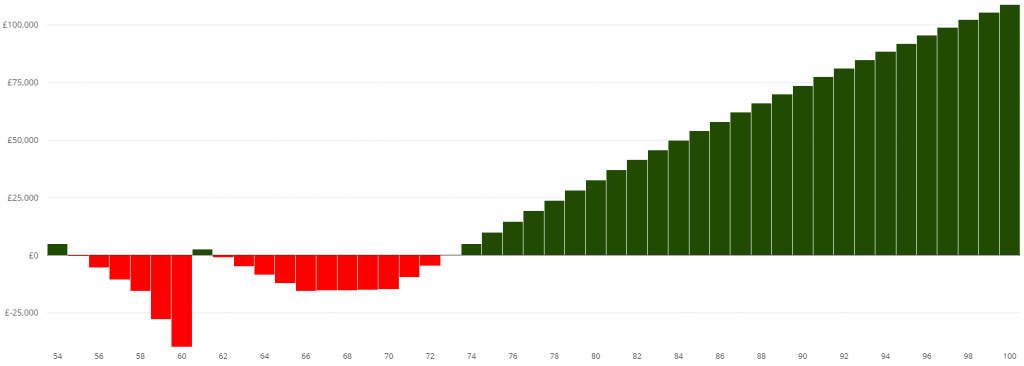

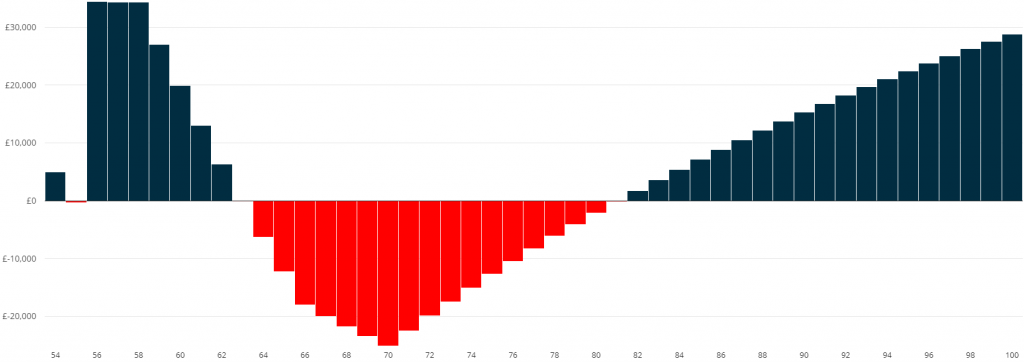

Cashflow planning can help you assess your current financial situation as well as looking at how your income and expenditure may change both in the near future and beyond. It can help you identify where you may experience a shortfall in your finances as well as helping to set achievable financial goals.

Cashflow planning is for everyone – from simple monthly forecasts to yearly predictions – it can help you to make accurate and informed financial decisions going forward. Many cashflow planning models allow you to simulate how your financial situation could potentially change should an unexpected event occur, such as a market crash.

Any financial forecasts that are created using cashflow planning are not set in stone and only give an indication as to what may happen in the future, so should be reviewed on a regular basis.

FE CashCalc has created a bespoke branded video for all users which explains the very basics of cashflow planning to clients.

Benefits to you

How can it benefit me?

Cashflow planning can provide you with a visual forecast of your finances, better informing you prior to making any big decisions without bombarding you with figures. Whether it be changing jobs, an early retirement or going back to university, you can use cashflow planning to assess the financial implications of this decision before you make it.

The beauty of cashflow planning software is that you are able to ‘see’ your finances laid out in front of you and then apply changes yourself to visualise and understand their impact. With the assistance of your financial adviser, you can then decide on the best plan going forward without the pressure of having to stick to one particular decision.

Cashflow planning is an ongoing, interactive process. Your adviser will involve you in the creation and ongoing development of your financial forecast rather than just talk you through the results, aiding your understanding. Even with specific financial data, cashflow planning breaks this down into simple and easy-to-understand illustrations. Ongoing reviews will also help you to keep on track with your financial goals reducing the chances of any unwanted surprises down the line.

It will help you see whether you can afford to retire early, take that once-in-a-lifetime holiday, help the children with their education, purchase a house in the country or tick that next adventure off your bucket list.

How can we help?

Here at Niche, we continue to use the UK’s number one cashflow planning tool within the FE CashCalc suite to provide you with a closer look at your current financial situation and potential financial future. We use the cashflow planning tool to demonstrate what could potentially happen when you make a particular decision.

By inputting information such as savings, income, expenses and retirement age into the cashflow planning tool, you can begin to understand how your goals can become a reality.

Here at Niche, our advisers are equipped to help you across the full range of different areas of your personal finances which include pensions, investments, pension sharing orders, equity release, mortgages and protection. We use the cashflow planning tool to look at your current position and compare this to simulations of what your finances could look like if you made different financial decisions.

The Financial Conduct Authority does not regulate Cashflow Planning.