Market Update: Tariffs & Turbulence

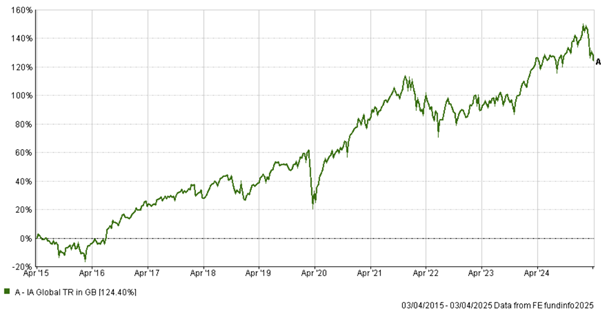

As ever with these articles, the intention is to explain factors affecting portfolios rather than a call to action. This volatility is completely normal in a market cycle, and I always urge investors to “zoom out” and look at the longer-term picture. As you can see on the chart below showing the IA global sector, even the sell off during covid in early 2020 becomes insignificant when you zoom out over 10 years and is even more so over 20. These movements which may feel significant at present, are just small blips in long term market trends. The falls over the last month come after a very strong year, so it’s important to view markets with a longer-term perspective. It’s easy to start to think that things won’t get better for a long time, but history tells us that this isn’t the case.

This week’s tariff announcement from the U.S. government has rattled global markets more than expected. In short, the news was worse than what most investors had prepared for.

Market expectations were based on an average tariff rate of around 15%, but the official announcement now points to rates closer to 18–20%, depending on which estimates you follow. Even at 15%, U.S. economic growth forecasts were already being downgraded by 1%. With higher tariffs, growth is likely to slow further—though exactly how much is still unclear. It’s important to remember; we’ve only seen part of the picture so far.

Is There a Silver Lining?

If you’re looking for reasons to stay optimistic, here’s one: markets may have already priced in the worst of the news. If that’s the case, and other countries respond by negotiating with the U.S. to lower these tariffs, then we may have already seen the peak of this particular downturn.

That said, there are still a couple of other possibilities:

- Scenario 1: If affected countries retaliate with their own tariffs, and the U.S. responds again, we could be in for a prolonged period of uncertainty.

- Scenario 2: Alternatively, countries may choose not to negotiate at all and instead adapt to the new tariffs. In this case, it’s worth noting that the U.S. President has the final say on whether a country has done enough to warrant a lower tariff, and that decision is ultimately subjective.

What the Markets are Telling Us

There’s a lot of movement happening across different parts of the market:

- U.S. Government Bonds have surged, which often signals that investors expect interest rate cuts in the near future.

- The U.S. dollar is falling sharply.

- Gold, typically seen as a safe-haven during times of economic uncertainty, is also under pressure - suggesting that inflation might not rise as much as previously feared.

- Energy prices, despite being mostly unaffected by tariffs, are dropping just as quickly as stocks - likely a reflection of concerns over slower global growth.

So what does this mean in practical terms? Lower growth usually leads central banks to cut interest rates. While that’s not ideal for economic momentum, it does make borrowing cheaper. For the U.S., that means financing its debt becomes more affordable. And let’s not forget: the U.S. government still has tools it can use to support the economy, including tax cuts and deregulation.

For now, we don’t expect a recession - but the risks have definitely increased.

A Global Perspective

Looking overseas, markets in Europe and the UK - especially large companies - have held up relatively well. Interestingly, this mix of global tension and domestic policy changes could create opportunities, particularly in industries like manufacturing and defence.

In the UK, market expectations are shifting too. Investors are now expecting three interest rate cuts in 2025, up from two - another sign of slowing growth but also of policy responses on the horizon.

Even in China, where the new tariffs hit the hardest, markets remained relatively stable. This is partly because there's confidence the Chinese government will focus more on boosting their domestic economy rather than just retaliating.

What Should You Do?

Market volatility is uncomfortable, but it’s not unusual! In times like these, having a diversified, well-considered investment strategy is more important than ever.

As always, if you have questions about how these developments may impact your portfolio or financial plans, don’t hesitate to reach out to our team.

As ever, these articles are for information purposes to highlight factors affecting markets at present, and are not a call to action. Should changes need to be made the managers will already be amending portfolios and we will have factored short term volatility in to our planning assumptions. If you do have any queries please don't hesitate to contact your adviser.

About

Aled Phillips

: Aled is a Fellow of the PFS, a Chartered Financial Planner, and a Chartered Fellow of the CISI.

Call: 01633 851805

Email: info@nichepc.co.uk

Office: 5 & 6 Waterside Court, Albany St, Newport, NP20 5NT

Become a client Client login

The contents of this article do not constitute financial advice in any way; if you have any concerns about your finances you should talk to your financial adviser. The value of your investments can go down as well as up.

< Back to Blog